Using Hsa To Reduce Taxes . Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more.

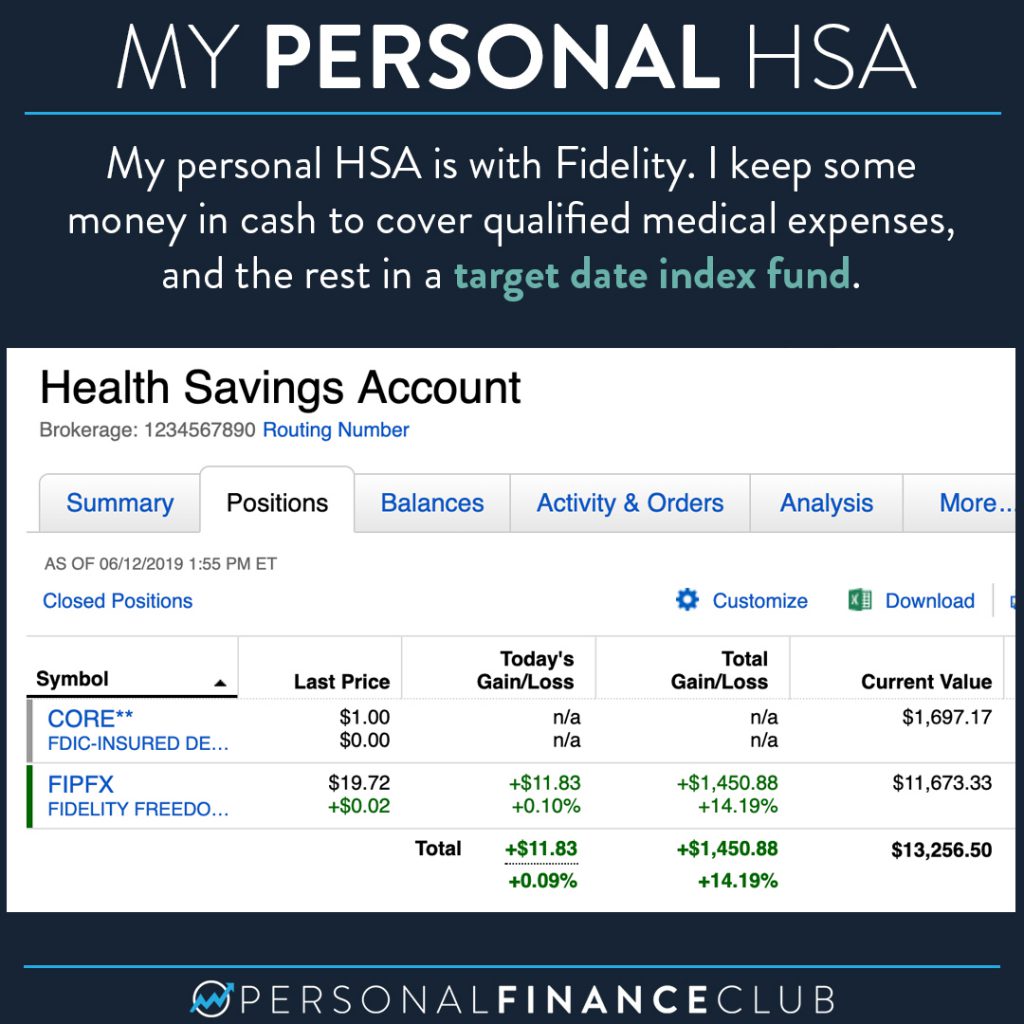

from www.personalfinanceclub.com

Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more.

How does an HSA work? (The Ultimate HSA Guide) Personal Finance Club

Using Hsa To Reduce Taxes In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more.

From www.slideserve.com

PPT Health Savings Accounts (HSA) Basics PowerPoint Presentation Using Hsa To Reduce Taxes In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. Using Hsa To Reduce Taxes.

From insights.wjohnsonassociates.com

6 Strategies to Reduce Taxable for HighEarners Using Hsa To Reduce Taxes Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Using Hsa To Reduce Taxes.

From advantageadmin.com

HSAs & Taxes Advantage Administrators Using Hsa To Reduce Taxes In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. Using Hsa To Reduce Taxes.

From ourfamilylifestyle.com

What Is an HSA Tax Form and Do You Need It? Using Hsa To Reduce Taxes Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Using Hsa To Reduce Taxes.

From thelink.ascensus.com

Triple Tax Advantage of HSAs — Ascensus Using Hsa To Reduce Taxes Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Using Hsa To Reduce Taxes.

From www.slideserve.com

PPT HSA 101 A Quick Review of Health Savings Account Basics Using Hsa To Reduce Taxes In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. Using Hsa To Reduce Taxes.

From managingfi.com

Health Savings Account (HSA) The Best Tax Advantaged Account Managing FI Using Hsa To Reduce Taxes Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Using Hsa To Reduce Taxes.

From www.personalfinanceclub.com

How does an HSA work? (The Ultimate HSA Guide) Personal Finance Club Using Hsa To Reduce Taxes Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Using Hsa To Reduce Taxes.

From www.pinterest.com

HSAs the triple tax advantage Living on the Cheap Health savings Using Hsa To Reduce Taxes Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Using Hsa To Reduce Taxes.

From www.linkedin.com

The Tax Secrets of HSAs Using Hsa To Reduce Taxes Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Using Hsa To Reduce Taxes.

From www.kitces.com

How To Quickly (And TaxEfficiently) Draw Down HSA Assets Using Hsa To Reduce Taxes Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Using Hsa To Reduce Taxes.

From www.ramseysolutions.com

HSA Tax Benefits Ramsey Using Hsa To Reduce Taxes In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. Using Hsa To Reduce Taxes.

From www.pinterest.com

Retirement and HSA contributions how they can help save on taxes Using Hsa To Reduce Taxes In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. Using Hsa To Reduce Taxes.

From www.jefferson-bank.com

What is a Health Savings Account (HSA)? Jefferson Bank Using Hsa To Reduce Taxes In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. Using Hsa To Reduce Taxes.

From www.firstambank.com

Your HSA and Your Tax Return 4 Tips for Filing First American Bank Using Hsa To Reduce Taxes Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Using Hsa To Reduce Taxes.

From www.smartfamilymoney.com

Why You Should Max Out Your HSA Contributions Smart Family Money Using Hsa To Reduce Taxes Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Using Hsa To Reduce Taxes.

From www.echohuang.com

What You Need to Know about Health Savings Accounts (HSAs) Using Hsa To Reduce Taxes Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Using Hsa To Reduce Taxes.

From www.msn.com

9 Smart Tax Moves To Make Before the End of the Year Using Hsa To Reduce Taxes Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. In 2023, that means having an individual health insurance plan with a deductible of $1,500 or more or a family plan with a deductible of $3,000 or more. Using Hsa To Reduce Taxes.